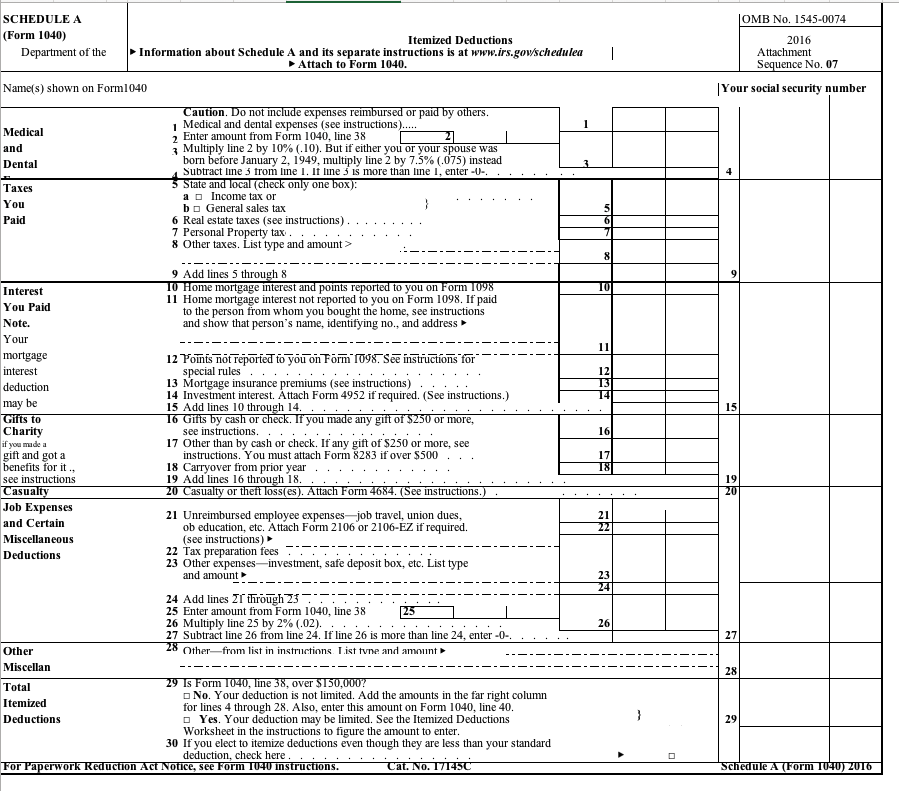

Just to name a few, these tax items are nowhere to be found, as they were eliminated for the 2018 tax year: While the new Form 1040 isn't quite as simplified as it may appear at first glance, there are a few things that are no longer on the form or on any of its numerous schedules, thanks to the Tax Cuts and Jobs Act. Some parts of the old form are gone completely

The topic of "which 1040 do I use?" often confused taxpayers, so now this will not be an issue. Now, the latter two forms will no longer exist, and all Americans will use the same Form 1040 to file their taxes.

And finally, the 1040-EZ was for the simplest tax situations. The 1040-A is commonly known as the "short form," and could be used by taxpayers with relatively simple tax situations, such as not itemizing deductions, not owning a business, and having a taxable income under $100,000. The standard form 1040 could be used by anybody, but was rather complicated. Previously, there were three versions of the 1040. If you're wondering why the IRS would take one tax form (the old 1040) and effectively replace it with seven (the new 1040 plus the six new schedules), there's actually a pretty valid reason. So, the overall paperwork hasn't become as simple as the new Form 1040 might make it seem.

The bottom line is that while the 1040 itself has gotten smaller, most of what was removed has simply been transferred to these schedules. Schedule 6 is where you can appoint a third-party designee to discuss your tax return with the IRS on your behalf.Schedule 5 is to add up tax payments, such as estimated tax payments or amounts paid with an extension.Schedule 4 is where taxpayers will add up certain taxes, such as self-employment tax, uncollected Social Security and Medicare taxes, and others.Schedule 3 is for nonrefundable tax credits.Schedule 2 is a form for people with some other forms of taxes, such as on a child's unearned income.Schedule 1 is for taxpayers with additional sources of income (not from a W-2) or adjustments to income, such as IRA contributions, student loan interest, and health savings account contributions.The new schedules are designated by numbers instead of letters, and here's a quick overview of what the new schedules are for:

0 kommentar(er)

0 kommentar(er)